Thriving in the Digital Age: Ecommerce Market Trends in China for 2024

May 4th, 2023 · Written by Zippora Lau

Contents

China's Ecommerce market is not only one of the largest but also one of the fastest-growing in the world. By 2027, the number of Ecommerce users in China is projected to reach a staggering 1.33 billion, with a market volume of $2.3 billion. The combination of China's massive population, rising purchasing power, and rapid technological advancements make it a market that cannot be ignored by businesses looking to expand their Ecommerce presence.

To succeed in China's dynamic Ecommerce landscape, businesses must stay updated with the latest trends shaping the market. Here are some key trends that are expected to dominate the Ecommerce market in China in 2024:

1. Social Ecommerce

Social Ecommerce has unique features in China, where social media platforms are pivotal in driving Ecommerce transactions. Platforms like WeChat, Weibo, and Douyin (the Chinese version of TikTok) have become popular channels for brands to engage with customers, build brand awareness, and drive sales.

One key aspect of social Ecommerce in China is the integration of shopping features within these platforms. For example, WeChat mini-programs allow businesses to create fully functional online stores within the WeChat app, offering a seamless shopping experience for users without ever leaving the platform. Similarly, Douyin has integrated direct shopping and payment features, allowing users to purchase products with just a few taps within the app.

This integration of shopping features within social media platforms makes it convenient and frictionless for consumers to discover and purchase products. This trend is expected to grow even more in 2023 and beyond.

2. Mobile Dominance

Mobile Ecommerce has emerged as the dominant force in China's Ecommerce landscape and is expected to continue its growth trajectory in 2023.

In 2022, over 1.03 billion people in China accessed the internet through their mobile phones , and this figure is projected to surpass the 1.2 billion mark by 2027. With a large portion of China's population relying on smartphones to access the internet, mobile commerce has become the primary mode of online shopping in China.

Mobile apps, wallets, and payment methods like Alipay and WeChat Pay have become integral to the Chinese consumer's daily life. These digital payment methods are widely adopted, offering seamless and convenient mobile checkout experiences and enabling consumers to purchase with just a few taps on their smartphones.

Furthermore, mobile marketing channels have become crucial for businesses to reach and engage with customers. Mobile advertising, in-app promotions, private groups, and social media marketing targeted toward mobile users are effective strategies to capture the attention of Chinese consumers.

3. Live Streaming

Live commerce, a unique blend of entertainment and instant purchasing, has emerged as a powerful sales channel in China, offering retailers, brands, and digital platforms an innovative way to create value. The Chinese retail giant Taobao pioneered the concept of live commerce in 2016, linking online live-stream broadcasts with Ecommerce stores to enable viewers to watch and shop simultaneously. Since then, live commerce has rapidly transformed the retail industry in China, establishing itself as a major sales channel in less than five years.

In 2024, live-streaming Ecommerce became only more robust, gaining immense popularity on platforms like Taobao Live, Douyin, Kuaishou, and Xiaohongshu (Little Red Book). These platforms give brands a unique opportunity to showcase their products, engage with consumers, and generate sales through live streams. Viewers can instantly purchase featured products while participating in the live stream through chat functions or reaction buttons, creating a real-time and interactive shopping experience.

Brands can leverage the engaging nature of live streams to showcase product features, provide demonstrations, and interact with viewers in real time, creating a sense of urgency and excitement that can lead to increased sales.

4. Cross Border Ecommerce

Cross border Ecommerce has been a significant trend in China's Ecommerce market in recent years, and it is expected to continue to grow in the future. Chinese consumers have shown a strong appetite for foreign products, driven by factors such as increasing disposable incomes, changing consumer preferences, and a growing middle class with a desire for high-quality and unique goods.

In recent years, the Chinese government has also introduced favorable policies to support cross-border Ecommerce, including tariff reductions, simplified customs clearance procedures, and increased import quotas, further stimulating the growth of this trend. As such, cross-border Ecommerce is expected to continue to be a significant trend in China's Ecommerce market in 2024 and beyond.

Brands may also focus on localization strategies, such as adapting their products, marketing messages, and customer service to cater to Chinese consumers' preferences and cultural nuances.

5. Adapting Omnichannel Strategies

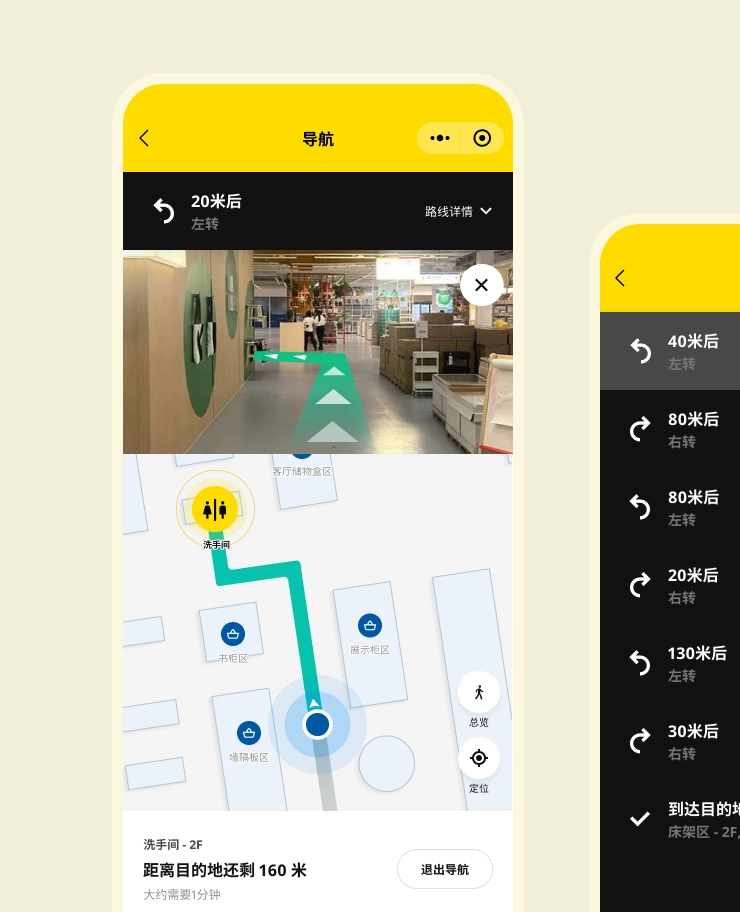

Omnichannel retailing, which refers to the integration of online and offline sales channels, is another key trend in China's Ecommerce market for 2023.

Chinese consumers demand convenience and flexibility, and businesses need to provide a seamless and integrated shopping experience across multiple channels, including online marketplaces, social media, offline stores, and mobile apps. Brands that adopt omnichannel strategies, such as click-and-collect, buy-online-pick-up-in-store (BOPIS), and offline-to-online (O2O) initiatives, are likely to meet the evolving expectations of Chinese consumers and gain a competitive edge in the market.

6. Shift From KOL to KOC and COL

The shift in Chinese Ecommerce trend from Key Opinion Leaders (KOLs) to Key Opinion Consumers (KOCs) and Cultural Opinion Leaders (COLs) is driven by Chinese consumers increasingly looking for authentic, niche, relatable, and culturally relevant content when making purchasing decisions.

KOCs and COLs, who are everyday consumers with genuine interest and expertise in specific product categories, provide peer recommendations, user-generated content, and specialized insights that resonate with consumers, foster trust, and encourage engagement. This shift is also influenced by China's evolving social media landscape, with the rise of short-video platforms, live streaming, and social commerce. These provide opportunities for KOCs and COLs to generate content that aligns with Chinese consumers' changing preferences and expectations in the digital era.

7. Community Group Buying

Community group buying is a booming Ecommerce trend in China, where consumers come together as a community to purchase goods or services in bulk at discounted prices collectively. It all started with the launch of Pingduoduo, an Ecommerce platform that offers group deals with the benefits of convenience, cost-effectiveness, and social interaction. Initially popular in lower-tier cities, the landscape of group buying is now changing.

The 2022 Shanghai lockdown boosted community group buying. During this period, organizers invited residents from the same community to join group chats to discuss and purchase products together. This created more interaction among neighbors, fostered a sense of community, and facilitated information-sharing. As a result, residents had stronger bargaining power and could secure better prices.

In addition to price, product quality is a crucial factor for community group buying consumers. Group chats serve as platforms for word-of-mouth information-sharing, enabling consumers to assess a product's worthiness. Brands must prioritize maintaining a high reputation and understanding consumers' needs and preferences. These group chats are considered authentic platforms for capturing evolving consumer preferences.

As the number of community group-buying consumers continues to rise across China, the industry will likely undergo adjustments. Platforms may rebrand to focus on upper-tier markets. The flexibility and adaptability to changing consumer preferences will be critical for brands and platforms seeking success in China's dynamic landscape of community group buying.

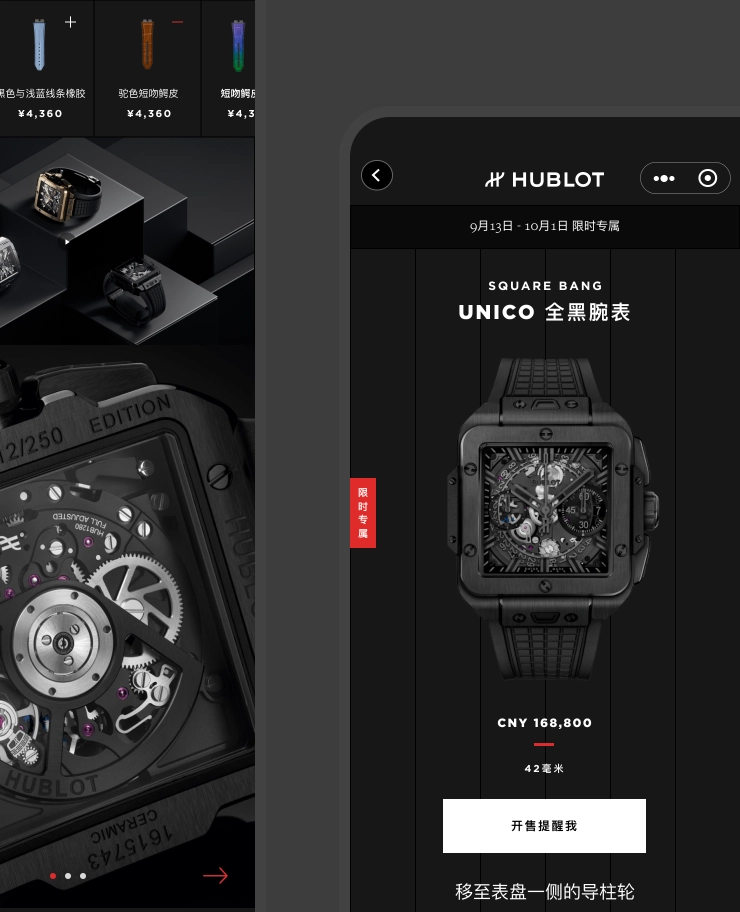

8. Technological Advancements in AI, AR, and VR

The rapid advancements in AI, AR, and VR technologies are revolutionizing the Ecommerce landscape in China, bringing about significant changes in how consumers shop online. These technologies enhance the shopping experience by providing personalized recommendations, enabling immersive shopping experiences, improving customer service, facilitating mobile payments, and optimizing logistics and supply chain operations.

AI algorithms are being harnessed by Ecommerce platforms in China to analyze vast amounts of data, allowing for better prediction of consumer behavior, offering more relevant product recommendations, and improving customization options.

AR and VR technologies are being utilized to create immersive shopping experiences where consumers can virtually try on products, visualize how items would look in their homes, or even explore virtual showrooms.

These technological advancements are reshaping consumer behavior and expectations. Businesses in the Chinese Ecommerce market need to leverage these technologies to meet the evolving demands of consumers and stay competitive in this rapidly changing landscape.

The Ecommerce market in China is projected to experience sustained growth and rapid evolution in 2024 and beyond. To thrive in the digital age of retail in China, businesses need to stay informed about current trends and adapt their strategies accordingly. Keeping up with the changing landscape and proactively adjusting approaches will be crucial for businesses aiming to succeed in the dynamic and competitive Ecommerce market in China.

Have a project in mind?

Join our newsletter!

Get valuable insights on the latest digital trends, strategies, and developments in China and globally delivered straight to your inbox.